The fear of NHS "privatisation" is a potent political force, often conjuring images of a fully-fledged, paid-for American-style system. The reality is more nuanced, but significant elements of healthcare delivery are already in private hands. This isn't always a secretive "backdoor" deal; much of it is mandated government policy designed to increase capacity and choice. However, the scale and cost have led critics to argue that this constitutes a creeping privatisation by another name.

The NHS has always engaged with the private sector—GPs are technically private partnerships, and dentists have a mixed model. However, the scope has expanded dramatically since the early 2000s with the introduction of an internal market and policies encouraging "any qualified provider."

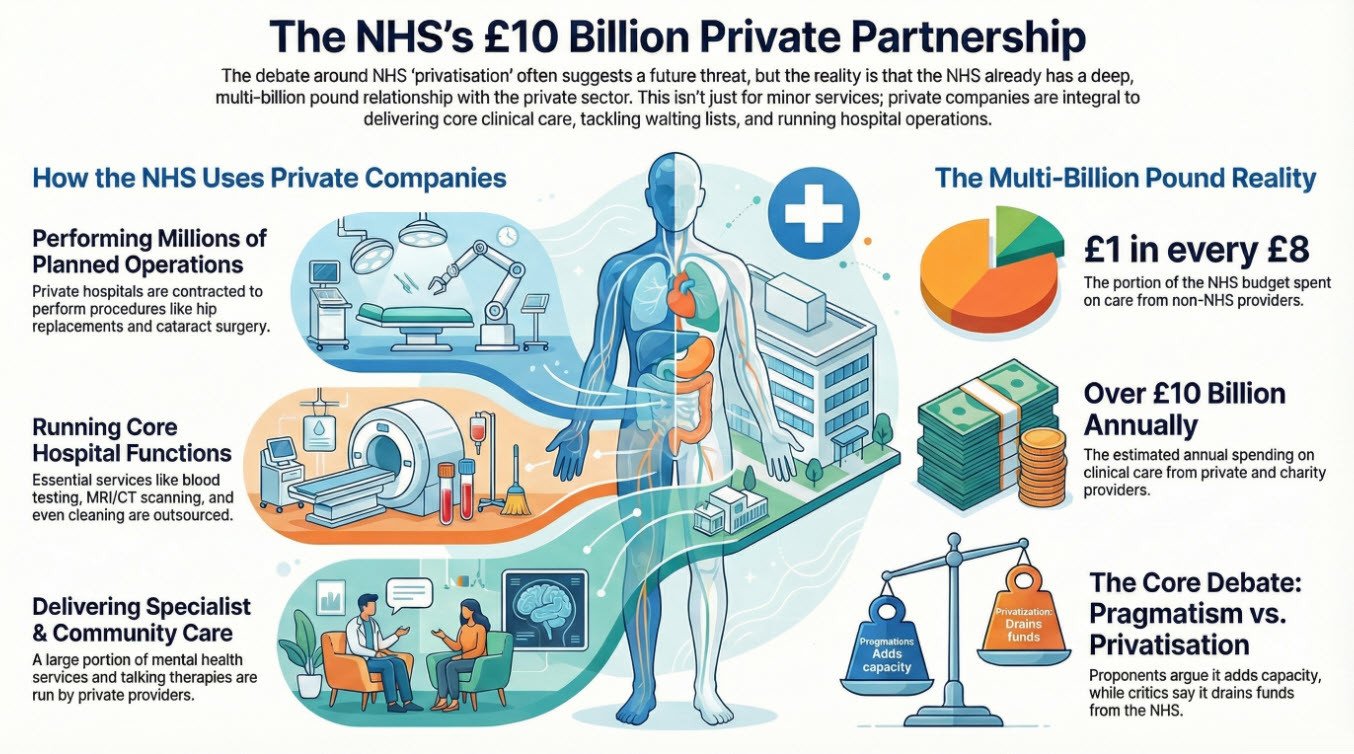

Here are the primary purposes for which the NHS currently uses the private sector:

- Elective (Planned) Care: This is the largest area. The NHS contracts private hospitals (like Spire, Nuffield Health, and Practice Plus Group) to perform millions of procedures annually to tackle waiting lists. This includes hip and knee replacements, cataract surgery, and diagnostic scans.

- Diagnostic and Support Services: Many services vital to hospital function are outsourced. This includes blood testing (via pathology labs like Viapath), MRI and CT scanning, and facilities management (cleaning, portering, and catering through companies like ISS and Sodexo).

- Mental Health and Community Services: A substantial portion of child and adolescent mental health services (CAMHS), as well as talking therapies under the IAPT program, are delivered by private and charitable organisations under NHS contract.

- Staffing Agencies: As previously discussed, the reliance on temporary staff from private agencies represents a massive financial transfer to the private sector.

- Consulting and IT: Large sums are spent on management consultants (like McKinsey and Deloitte) for restructuring advice and on private IT firms to develop and maintain digital patient records systems.

The Cost of "Backdoor Privatisation": A Multi-Billion Pound Reality

Putting a precise figure on "privatisation" is complex because NHS expenditure data is categorised by purpose, not by the public/private status of the provider. However, we can estimate the scale by looking at the budget for purchasing care from "non-NHS" providers.

According to a comprehensive analysis by the Nuffield Trust and the Institute for Fiscal Studies, the NHS in England spent £1 in every £8 of its budget on care from non-NHS providers in the years leading up to the pandemic. In concrete terms, this represented over £10 billion annually.

- Source: The Nuffield Trust's report, "The NHS spends £1 in £8 on care from non-NHS providers", breaks down this spending, showing a steady increase over the past decade.

This £10 billion+ figure is the clearest available estimate for what many would term "backdoor privatisation." It includes payments to private hospitals, charities, and other non-NHS organisations for clinical care. It does not include the additional billions spent on private agency staff, management consultants, and support service contracts.

The Critical Debate:

- Proponents argue this is a pragmatic use of spare private capacity to treat patients faster, claiming it increases competition and efficiency.

- Critics contend it siphons precious public funds into shareholder profits, fragments patient care, and creates a two-tier system where private providers "cherry-pick" less complex, profitable cases, leaving the NHS to handle more complex, costly emergencies. They argue it creates a vicious cycle: underfunding leads to long waits, which justifies more private spending, which in turn starves the NHS of the funds it needs to build its own capacity.

This established, multi-billion pound relationship with the private sector demonstrates that the question is not if the NHS will use private providers, but to what extent, and whether this represents a sustainable model or a gradual, fundamental shift in the character of the health service.

If you require assistance with this article, contact us.

Sources for "The 'Privatisation' Debate" Section

- The NHS spends £1 in £8 on care from non-NHS providers.

- Source: The Nuffield Trust. This independent health think tank published a landmark report titled, "The NHS spends £1 in £8 on care from non-NHS providers." The analysis is based on official NHS England data.

- Citation: Gershlick, B., & Fisher, R. (2019). The NHS spends £1 in £8 on care from non-NHS providers. Nuffield Trust. Available at: nuffieldtrust.org.uk/resource/the-nhs-spends-1-in-8-on-care-from-non-nhs-providers

- Key Stat: The report states that in 2018/19, the NHS in England spent £9.7 billion on care from non-NHS providers, representing 12.3% of its budget. This figure has since been reported to have exceeded £10 billion in subsequent years.

- Policies encouraging "any qualified provider" and the internal market.

- Source: The Health and Social Care Act 2012 is the primary legislation that accelerated this process. It extended competition and marketisation within the NHS.

- Citation: UK Government. Health and Social Care Act 2012. Available at: legislation.gov.uk/ukpga/2012/7/contents/enacted

- Context: The King's Fund, another highly respected health charity, provides excellent summaries of this legislation and its impacts.

- Citation: The King's Fund. (2013). The Health and Social Care Act 2013. Available at: kingsfund.org.uk/projects/health-and-social-care-act-2013

- Use of Private Hospitals for Elective Care.

- Source: NHS England routinely publishes data on its use of independent sector providers to reduce waiting lists.

- Citation: NHS England. (2023). NHS and independent sector partner to tackle waits. Available at: england.nhs.uk/2023/02/nhs-and-independent-sector-partner-to-tackle-waits/

- Example: This press release states the NHS has secured "up to 360,000 extra operations and appointments a year" through deals with private providers.

- Outsourcing of Diagnostics and Support Services.

- Source: Trade publications and company reports detail the extensive contracts won by private firms. For example, the outsourcing of pathology services to joint ventures like Viapath is well-documented.

- Citation: Viapath. "About Us: Our Partnership." Available at: viapath.co.uk/about-us/our-partnership

- Support Services: Companies like Sodexo and ISS publicly list the NHS as a major client on their corporate websites.

- Spending on Management Consultants.

- Source: Parliamentary questions and reports from groups like the TaxPayers' Alliance have highlighted this spending.

- Citation: House of Commons Library. (2021). Management consultants in the NHS. Available at: commonslibrary.parliament.uk/research-briefings/cbp-9212/

- Key Stat: This briefing notes that NHS spending on management consultants rose from £313 million in 2010/11 to £663 million in 2019/20.

These sources provide a robust, evidence-based foundation for the claims made about the scale and nature of private sector involvement in the NHS.