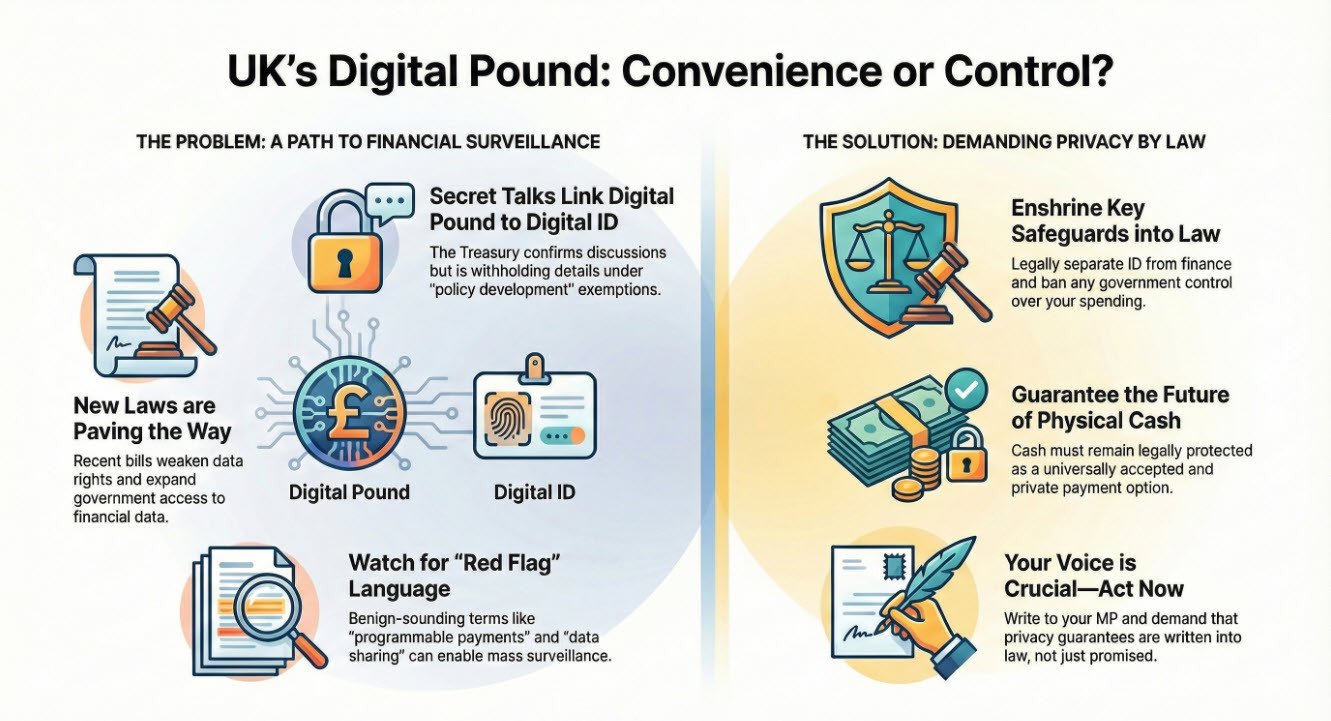

The UK government is privately discussing the integration of a Digital Pound with a Digital ID system. While promising modernisation, this combination risks creating a system of unprecedented financial surveillance unless key privacy safeguards are enacted into law.

Introduction: The Quiet Convergence

A fundamental shift is being planned for the UK's financial landscape. Through a Freedom of Information response, the Treasury has confirmed that government departments are actively discussing the relationship between a Digital ID system and a Digital Pound (a Central Bank Digital Currency, or CBDC).

The details remain secret, withheld under "policy development" exemptions. This file from the Scouse Oracle connects the dots from existing policies to a future where financial privacy could be permanently altered.

What’s Actually Happening: The FOI Revelation

The Treasury, in response to a Freedom of Information request (Ref: FOI2025/19796), confirmed that discussions on linking Digital ID and the Digital Pound are underway. However, they refused to share any specifics, citing Section 35(1)(a) of the FOI Act, which protects information related to policy development.

Currently, no law allows the government or Bank of England to monitor or control how you spend your money. But the crucial point is this: the digital infrastructure that could enable this is being designed right now. The legal ground is being prepared by a series of other bills, shifting the goalposts before the public is fully aware.

Why This Matters: Modernisation vs. Control

A digital pound offers potential benefits: modernising payments, reducing costs, and increasing security. However, its nature changes entirely if it becomes mandatory and is inextricably linked to a digital identity.

Privacy is strongest before the system is built. Once the architectural blueprint is set and the system is live, public oversight becomes little more than theatre. The goal here is not to spread fear, but to provide foresight—to scrutinise the design phase where it matters most.

The Policy Trail: The Laws Paving the Way

Several key pieces of legislation and policy are already shifting the legal framework:

- Digital Identity Roll-out (2025 onwards): Plans are in motion for mandatory digital ID for "Right to Work" checks and access to key public services.

- Data (Use and Access) Act 2025: This act expands government and third-party access to "customer data and business data," establishing the digital verification registers needed for a full ID system.

- Data Protection and Digital Information Bill (DPDI): This bill would weaken existing data rights and explicitly enable the bank-account monitoring of benefit claimants, setting a precedent for financial surveillance.

- The Digital Pound Programme: While a 2024 consultation promised privacy 'by design,' this is not yet law. Future legislation could easily introduce programmable features or formalise the link with Digital ID.

Red Flag Language to Watch For

As future bills are debated, be vigilant for specific terms that sound benign but have profound implications. These include:

- "Programmable payments"

- "Interoperable with digital identity frameworks"

- "Mandatory verification for access to services"

- "Data sharing for fraud prevention"

- "Central registers"

Individually, each term can be framed as reasonable. Combined, they form the architecture of a total-visibility ecosystem.

Non-Negotiables for Public Safety

To ensure a digital pound enhances, rather than diminishes, liberty, the following principles must be enshrined in law:

- Legal Separation: It must be illegal to link your identity data with your financial transactions. Your ID proves who you are; your wallet handles your money. No central database should hold both.

- Statutory Cash Protection: A law must guarantee that physical cash remains universally accepted and accessible. Cash is the only payment method that is truly private, resilient during power outages, and free from digital surveillance.

- Anonymous Low-Value Payments: The digital pound must function offline for small transactions without recording the parties involved, preserving the privacy of everyday purchases.

- Ban on State Programmability: The government or central bank must be legally prohibited from limiting how, where, or when you spend your money. No expiry dates, spending bans, or 'approved-only' categories. Programmability should be a tool for users, not the state.

- Independent Privacy Regulator: Oversight must be conducted by a body independent of the Treasury and Bank of England, with the power to audit code, review data-access requests, and publish mandatory transparency reports.

What You Can Do Right Now

Your voice is crucial in shaping this debate. Here’s how to get involved:

- Write to your MP: Ask for their stance on the link between Digital ID and the Digital Pound.

- Submit to Consultations: When government consultations are open, insist that privacy guarantees must be written into law, not just promised in design.

- Track Bills: Follow the progress of legislation concerning 'digital verification' and 'programmable money.'

- Support Privacy Groups: Organisations like Big Brother Watch and the Open Rights Group are on the front lines of this issue.

- Local Action: Encourage your local council to adopt policies that protect cash access and support voluntary, non-mandatory identity systems.

How Narratives Hide Power

Official language often frames secrecy as a necessity for safety. Phrases like “We can’t share details while we’re still formulating policy” sound protective but create blind spots where fundamental changes can be decided without public scrutiny. Transparency is not a risk to safety—it is its foundation.

Final Word

Innovation is not the enemy. But innovation without robust, pre-emptive legislation is control in its beta testing phase. The Digital Pound could free transactions from the grip of private banks, or it could anchor every payment to a state-monitored identity system. The difference will be determined by public scrutiny before the law is written.

This file is not about fear. It’s about watching the pen before it signs your freedom away.

Sources & Receipts

- HM Treasury FOI Response: FOI2025/19796 (24 Oct 2025)

- HM Treasury & Bank of England, Digital Pound Consultation Response (Jan 2024)

- Data (Use and Access) Act 2025 – Clauses 70(4) & 71(5)

- Data Protection and Digital Information Bill (DPDI) – Part 3 & Schedule 12

- Treasury Committee Evidence Sessions on Digital Pound Privacy (2024)

- Analysis and reports from Open Rights Group and Big Brother Watch.

If you require assistance with this article, please contact us.